Wealth Management

A seismic shift for the sector

Demographic change, demand for customization and a preference for digital interaction are just some of the shifts facing wealth managers and private banks

The wealth management industry is facing a seismic shift: the greatest wealth transfer in history1, the rise of digital trading, and growing appetite for sustainable investing. Perhaps the most consequential demographic change is the transfer of up to $84 trillion in assets from Baby Boomers2. Younger generations who inherit this wealth often have starkly different investment priorities- including a greater appetite for customization, a desire to invest sustainably, and a preference for digital interaction. They are more open to alternative asset classes such as private equity and cryptocurrency - for example, 75% of millennial and Gen Z investors surveyed by Bank of America3 believe it is not possible to achieve “above-average returns” using only traditional stocks and bonds.

For wealth managers and private banks competing to fulfil these preferences, access to quality data, analytics and technology will be critical. As a global markets operator, ICE can help them meet increasingly sophisticated client demands by providing data and analytics to power their systems. Alongside this, we offer robust technology and trading platforms so wealth managers can access efficiencies, better execution, and deliver quality client service.

Customization: demand for bespoke investments grows

Investor demand for bespoke strategies means customization is a clear trend: the use of separately managed accounts – personalized portfolios which are professionally managed – has nearly doubled among households with +$3 million in investable assets over the past two years4.

To meet this demand, ICE offers broad asset class and specialty data sets to help inform investment recommendations. We specialize in proprietary pricing for more complex asset classes like fixed income, along with instruments used by private banks to serve ultra-high net worth clients – such as OTC derivatives, structured products, and cryptocurrencies. Our evaluated pricing and reference data is offered on an intraday and end-of-day basis.

Customization is also a strong theme in indexing. Assets in direct indexing – a strategy that can provide greater autonomy and control to some investors – are forecast to grow to $1.5 trillion by 2025 up from $350 billion in 20205. Here, ICE’s Custom Index Tool offers wealth managers the ability to prototype bespoke solutions and back test strategies across multiple asset classes.

Sustainability: a growing part of many portfolios

Sustainability considerations are fast becoming an important part of investment risk assessment. In addition, over half of global investors recently surveyed by Morgan Stanley6 anticipate boosting their sustainable investments in the next year.

For market participants who wish to assess climate risk, the move to net zero emissions, impact investing, or corporate ESG performance, ICE offers comprehensive sustainable finance data, tools and indices. Climate concerns are also a growing focus for mortgage-backed security investors, where assets may be exposed to a rising frequency and severity of climate events. Here, investors can access risk impact estimates for residential and commercial mortgage-backed securities, gaining insights which can be applied at the property, loan, deal, and security levels.

Digitization: delivering a better client experience

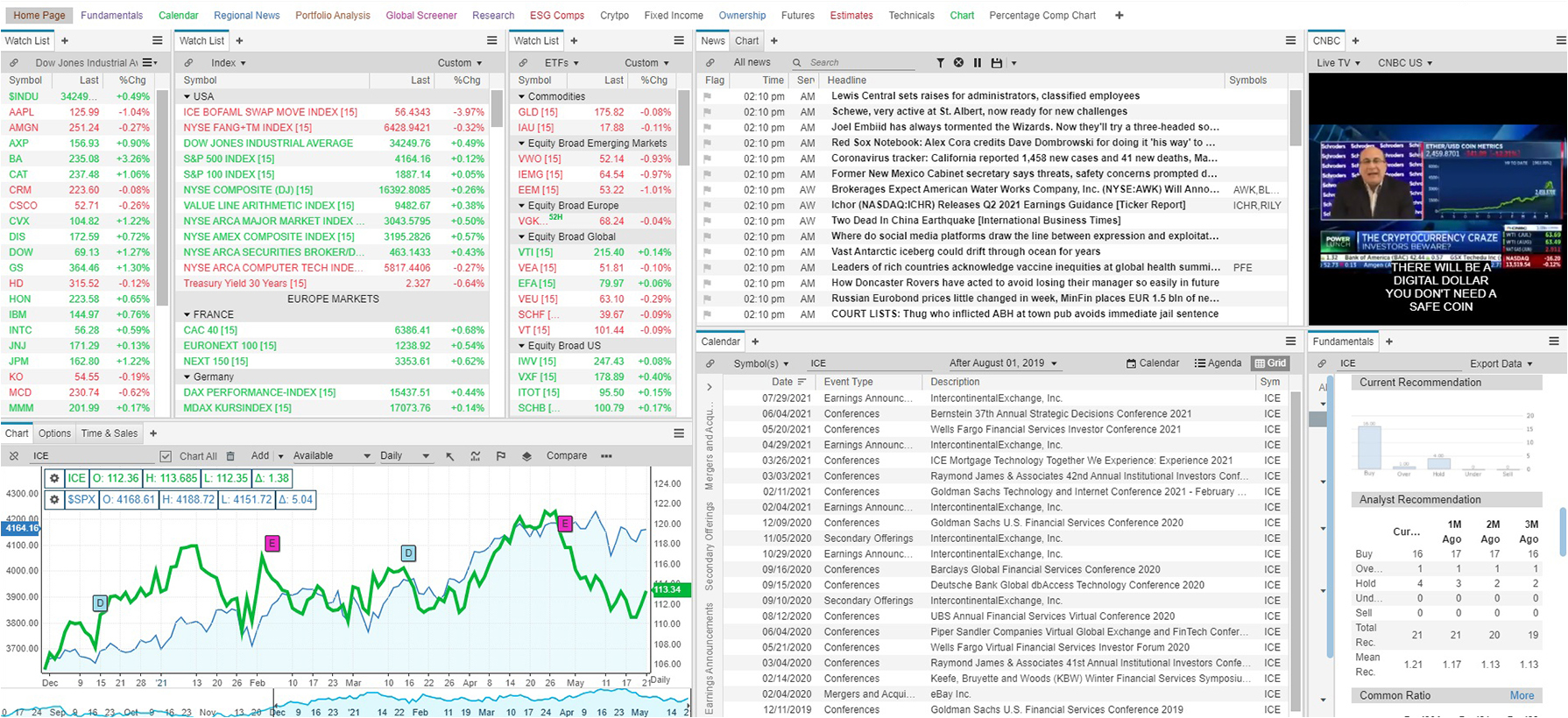

Wealth management firms which focus on brokerage and advice may lack the infrastructure to facilitate high net worth traders. Many are also grappling with how to upgrade legacy technology. Our wealth management desktop offering provides an ever-expanding library of multi-asset class data, news, quotes and analytics. ICE also offers a private label capability for firms to create their own online workspaces, integrating client accounts and positions, while a widget library allows them to add components to their own platforms.

Across fixed income markets, the digitization of trading is gaining momentum - but reliable liquidity can be hard to access. For wealth managers and banks seeking fixed income execution, ICE Bonds offers private-label technology with access to its liquidity providers via a platform for discovering and trading fixed income securities. ICE Bonds’ solutions reach over 200,000 advisors, with 60+ custom implementations serving over 700 financial firms. In addition, our streaming fixed income evaluated pricing is used by wealth managers for efficient price discovery, pre-trade analysis and demonstrating best execution.

While it is impossible to know how investor preferences will continue to shift, some elements remain constant: quality data will underpin sound decisions, supported by advanced technology and analytics. And amid an onslaught of market information, those who can best manage these tools will be best-placed to help their clients manage risk, and spot opportunity.

A snapshot of ICE Connect