Exchange & Smart Order Entry

WebICE offers a variety of Exchange and Smart Order functionality to facilitate execution.

- Day

- Market

- Good Till Cancelled (GTC)

- Good After Logout (GAL)

- Good Till Date (GTD)

- FAK (Fill And Kill)

- FOK (Fill Or Kill)

Reserved Quantity

Reserved Quantity is a convenient way of executing large orders in a series of small increments. This feature re-posts an order when it is filled, at the same quantity and at the same price, until the Total Quantity specified has been filled.

Smart Order Types

Available orders types exclusive in WebICE to control the validiity of an order are as follows:

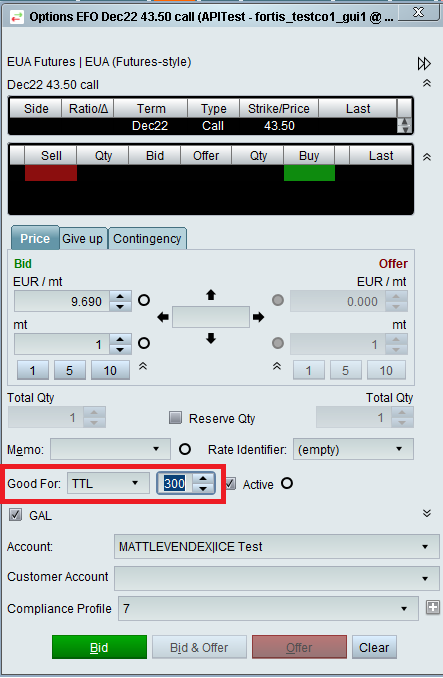

TTL (Time To Live)

Smart Order, TTL will give the user the ability to set the number of seconds they want the order to live. When the time elapses, the user has the option to set the desired action - hold or kill when time expires.

GTDate with Time

Users can submit a ‘GTDateTime’ order by selecting this value under the ‘Good For’ drop-down on order entry. Time can be specified in hh/mm in local time zone in addition to a date so as to indicate when an order should expire (Time can be within the same day/ session or a future session). If no time is specified then the order will expire at the end of the session on the specified date.

‘Good for’ column will display ‘GTDateTime’ and ‘Good Till Date’ column will display the user specified time along with the date for such orders in the WebICE Orders tab.

Scaled Order with Reserved Quantity

We have supported Scaled Order entry via Trade (WebICE) whereby a user interested in getting an average price submits multiple orders at scaled prices through a single ticket. Users will have the option to submit Scaled orders with Reserve quantity (via WebICE only). There will be a new ‘Reserve’ checkbox on the Scaled order entry ticket.

OCO (One Cancels Other)

The OCO order type provides a user the ability to place two orders with a link between them so that if one order is filled or partially filled, the other order is withdrawn / killed immediately. The OCO order type is only available on WebICE in the new enhanced ICE Order Ticket.

OCO orders will support:

- Limit & Limit

- Stop & Stop

- Limit & Stop

Contingency Orders

Contingency functionality allows a user to set a price trigger and when the trigger price is met, take action on an order, by either making the order active or withdrawn from the market. The Contingency order is only available on WebICE in the new enhanced ICE Order Ticket.

Supported with:

- Limit

- GAL

- Time in Force

- Stops

- Reserved Quantity

Bracket Orders

Floating a bracket order allows a user to place an order in the market on one side and specify two pending orders (OCO) on the opposite side to cover a loss (stop order) or generate a profit (limit order) which will be floated out should the original order get filled.

Stops with Limits and Trailing

WebICE offers Stop orders with Protection for Futures Markets. ICE stop orders will offer an exchange set protection limit and will not convert to a conventional stop market order.

Trailing Stops are a type of stop loss order that combines elements of both risk management and trade management. Trailing stops are also known as profit protecting stops, because they are used to keep a particular amount of profit in addition to preventing a loss. The trailing stop is initially placed in the same manner as a regular stop loss order.

For example, a trailing stop for a long trade would be a sell order, and would be placed at a price that was below the trade entry (and the exact opposite for a short trade). The main difference between a regular stop loss and a trailing stop is that the trailing stop automatically moves as the price moves. For example, for every five ticks that the price moves, the trailing stop would also move five ticks. Trailing stops only move in one direction (with the trade), so if the price moves with the trade (i.e. into profit) the trailing stop moves with it, but if the price moves against the trade (i.e. taking profit away) the trailing stop stays still.

New version 15.150 available

Application Programming Interface (API)

WebICE supports straight-through trade processing with your clearing firm, and your internal middle-office system. ICE Trade Capture API is available for companies to receive in real-time all the trades done (both screen and block trades) into their middle office system.