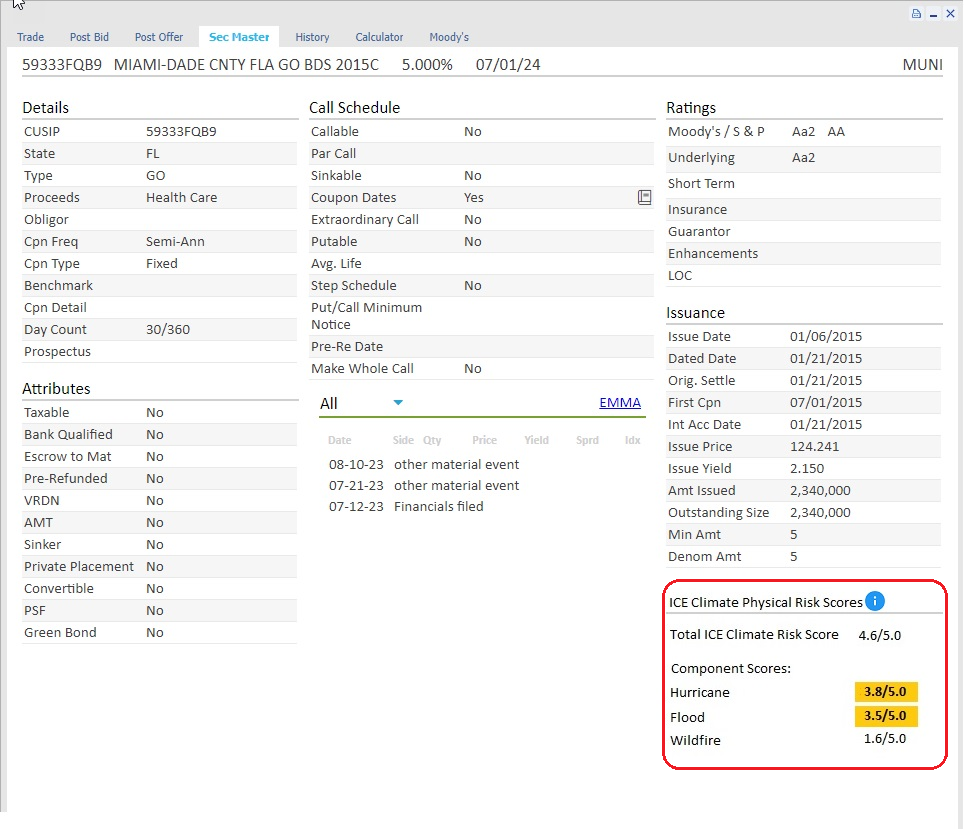

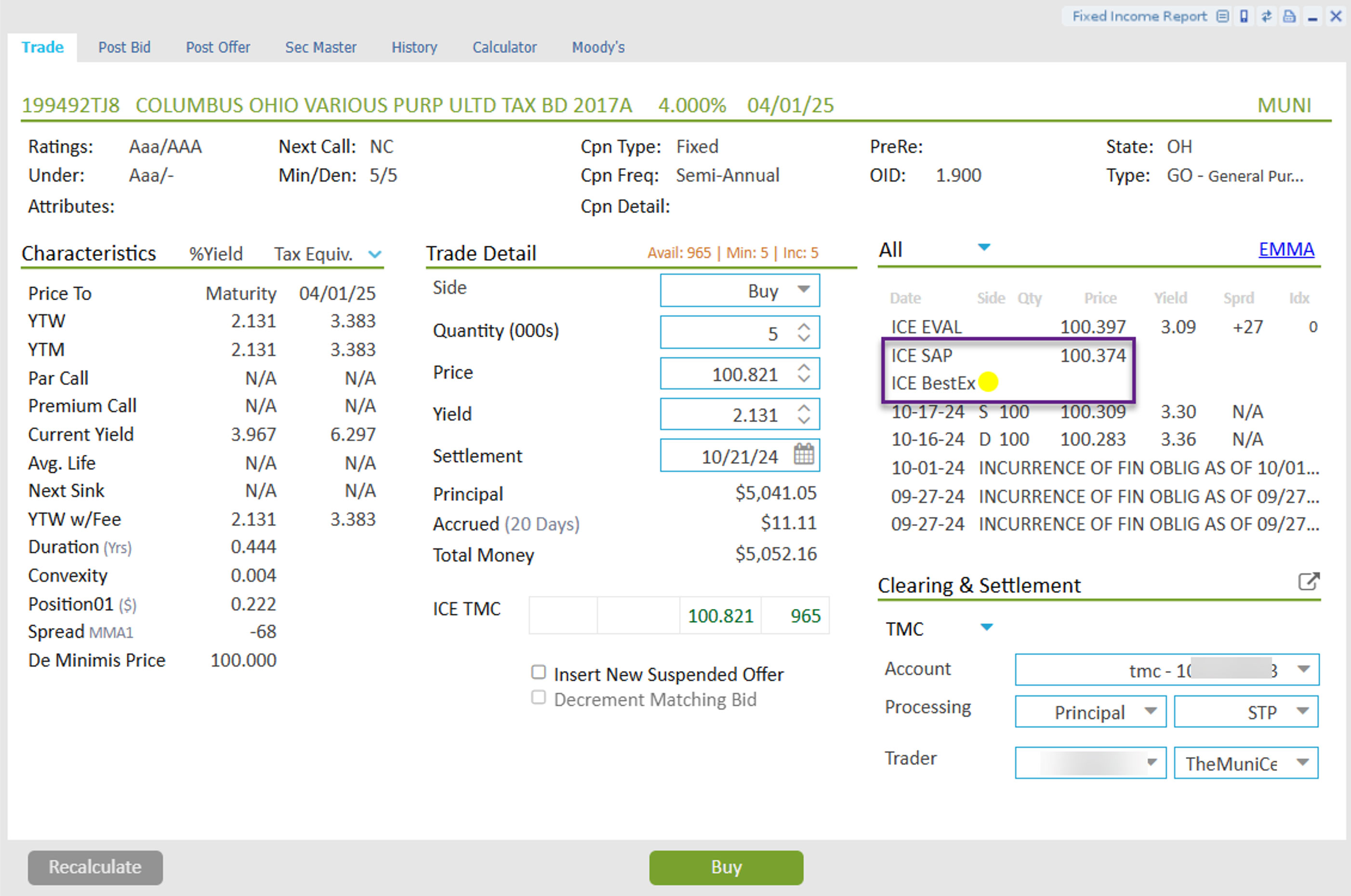

Adding color display mapped to the ICE Data Services BestEx scores and Size-adjusted Pricing (SAP) data within the Trade Ticket along with currently available ICE End of Day Evaluated price and ICE Continuous Evaluated Price (CEP)1. ICE is currently making this available to any Trader Workstation user to highlight this new functionality. Further enhancements will allow this content to be leveraged in other areas to improve workflow efficiency and data validations, such as Rule Based Approval.

1For information about ICE’s Best Execution service, please see the Best Execution Scoring Methodology - Fixed Income Securities which is available upon request. For information about ICE’s EOD evaluations and CEP and SAP, please see the Methodology Binder which is available upon request." to the first enhancement, "ICE BestEx and ICE Size Adjusted Pricing Data", including the link to ICE Best Ex site, https://www.ice.com/fixed-income-data-services/data-and-analytics/pricing-and-analytics/analytics/bestexecution

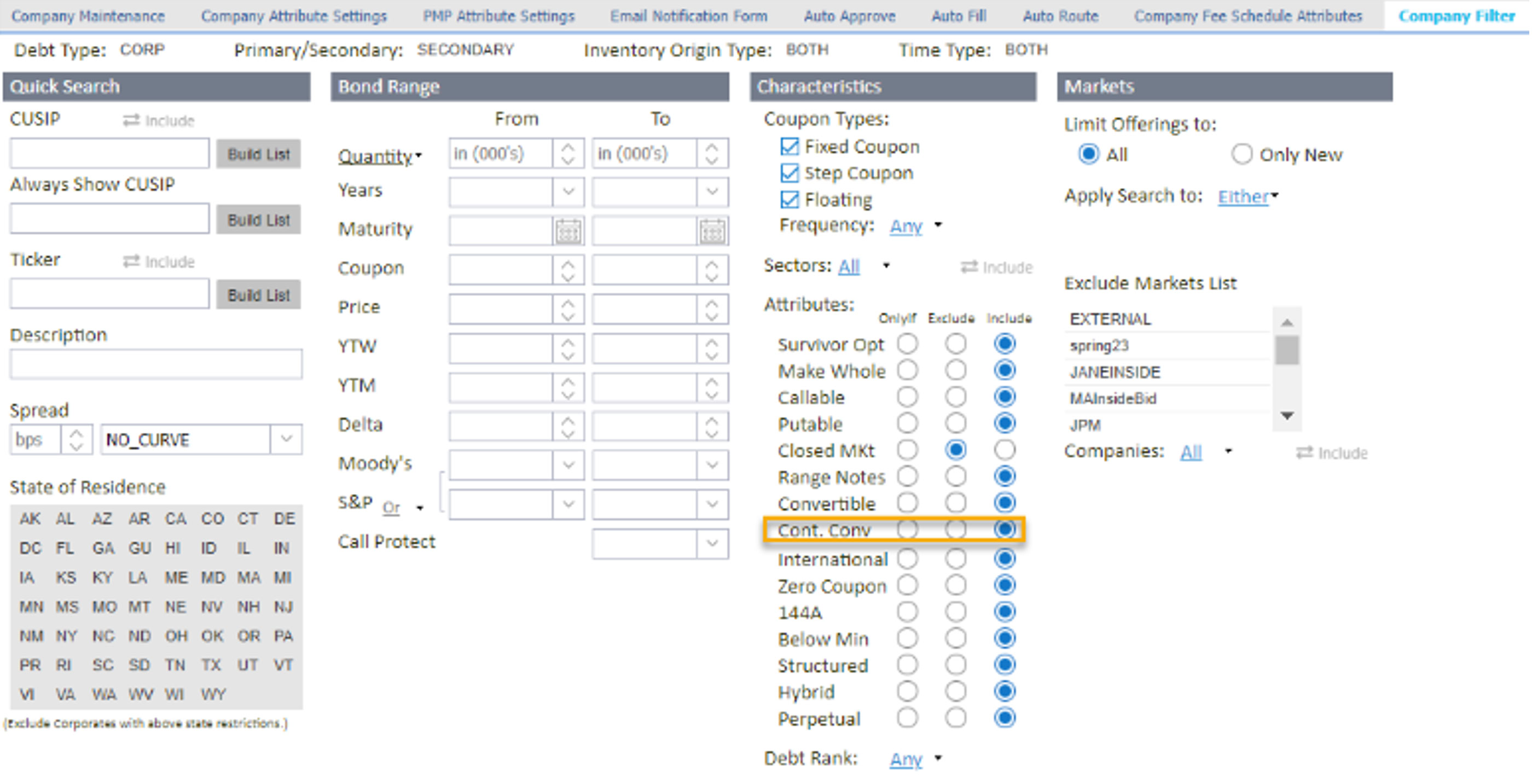

Allow firms to set individual fat finger limits per asset class vs the current single limit on all trade activity providing more flexibility for firms in setting market access controls.

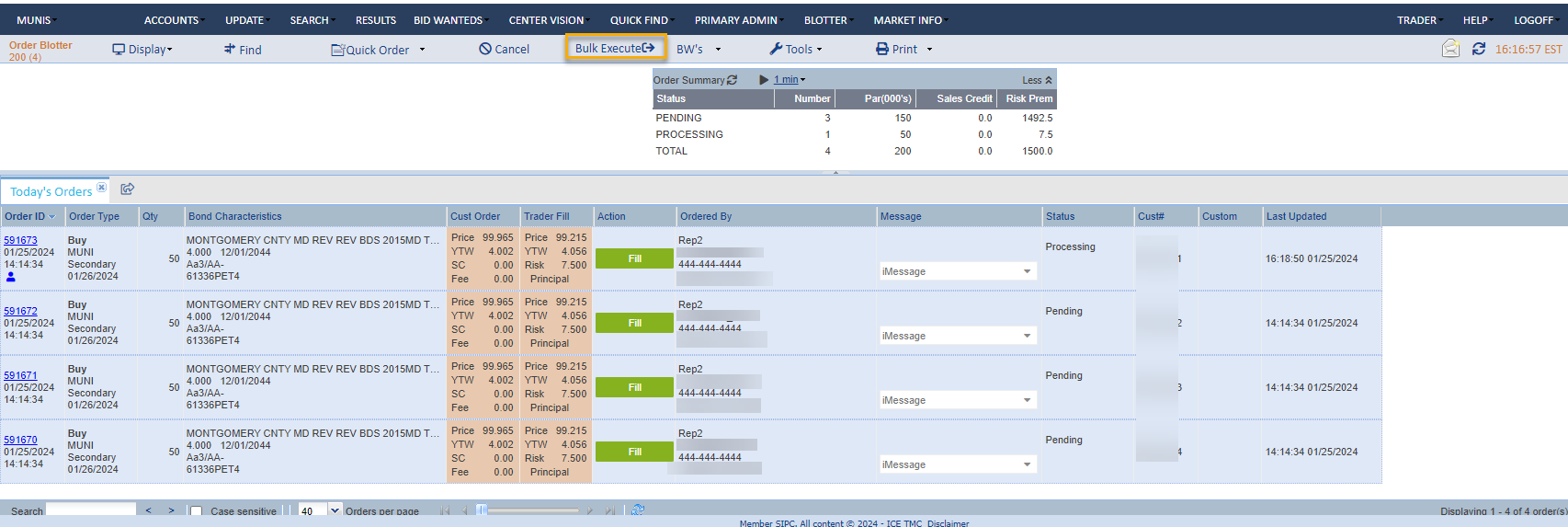

Provide additional flexibility for firms leveraging Rule Based Approval to force bulk orders to stop at desk or allow the individual orders to be routed for execution.

Working with ICE Data Services (IDS), TMC is now able to source the updated day-count code for “fixed-to-floaters” when its in the floater period.

For CD only, add an Early Settle (before dated date) option to company filter.

Additional Enhancements and Bug Fixes

- Add MBS Market Data -- previously only available on the front-end, posted MBS offerings will now be available to be sent through market data feeds along with support for corresponding order flows through the feed

- Add CEP for MBS -- add MBS ICE CEP pricing to platform

- Allow Auto Accepting and Allocation Primary Orders -- expand the capability of auto-accepting and allocating primary orders against both own inventory and ATS, control via new company attributes

- Set CD Default Values -- supply default values for multiple data points that frequently miss security master data -- original settle, day count, trade size minimum and denomination increment

- Fix Password Reset Link -- fix URL error when resetting password from Web-based e-mail applications

- Fix MBS Calculations -- fix incorrect MBS calculations for net price and principal amount

Limitations

Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations and Size-Adjusted Pricing, are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

Trading and execution services are offered through ICE Bonds Securities Corporation or ICE Bonds, member FINRA, MSRB and SIPC. The information found herein, has been prepared solely for informational purposes and should not be considered investment advice, is neither an offer to sell nor a solicitation of an offer to buy any financial product(s), is intended for institutional customers only and is not intended for retail customer use.