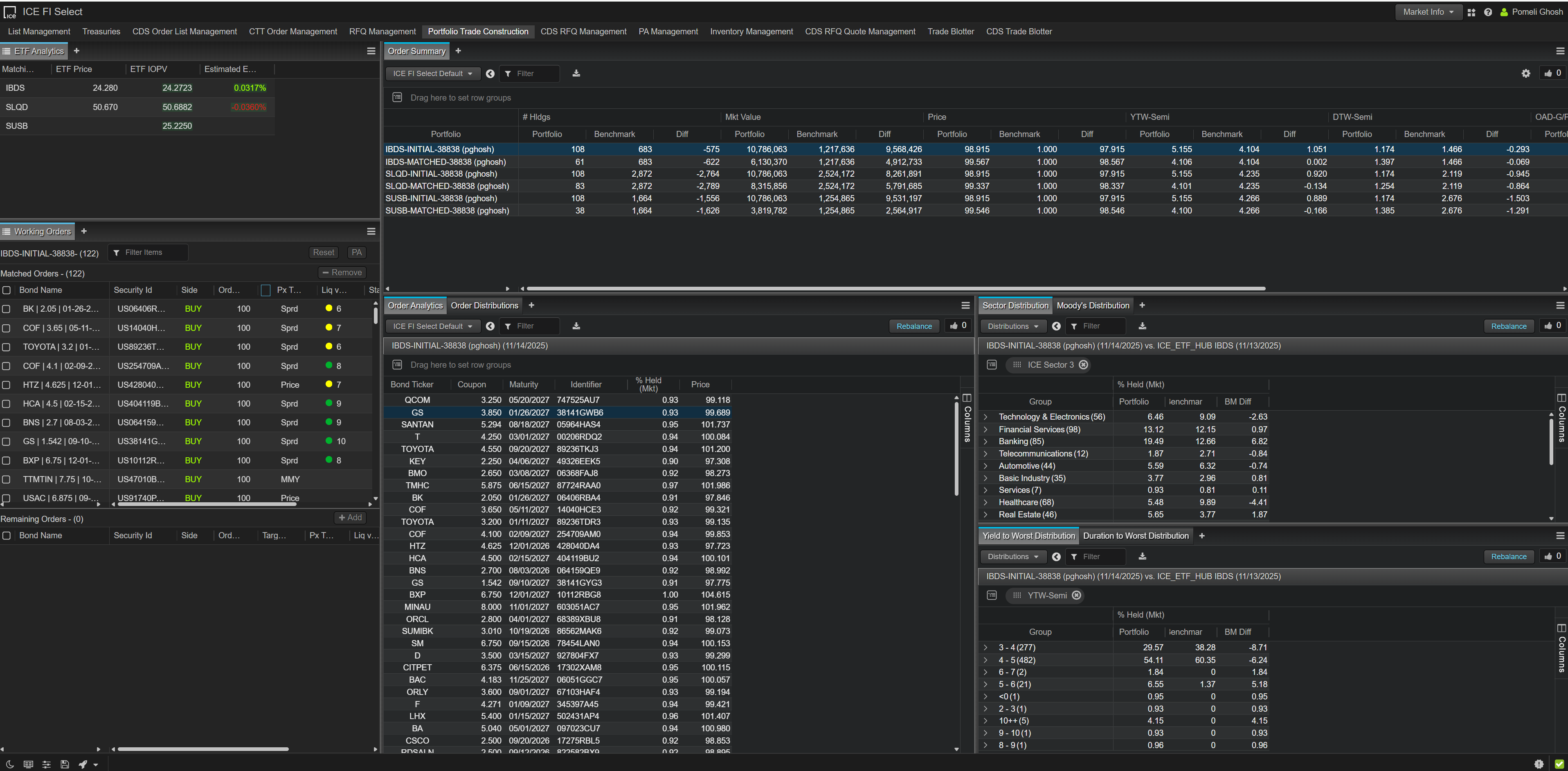

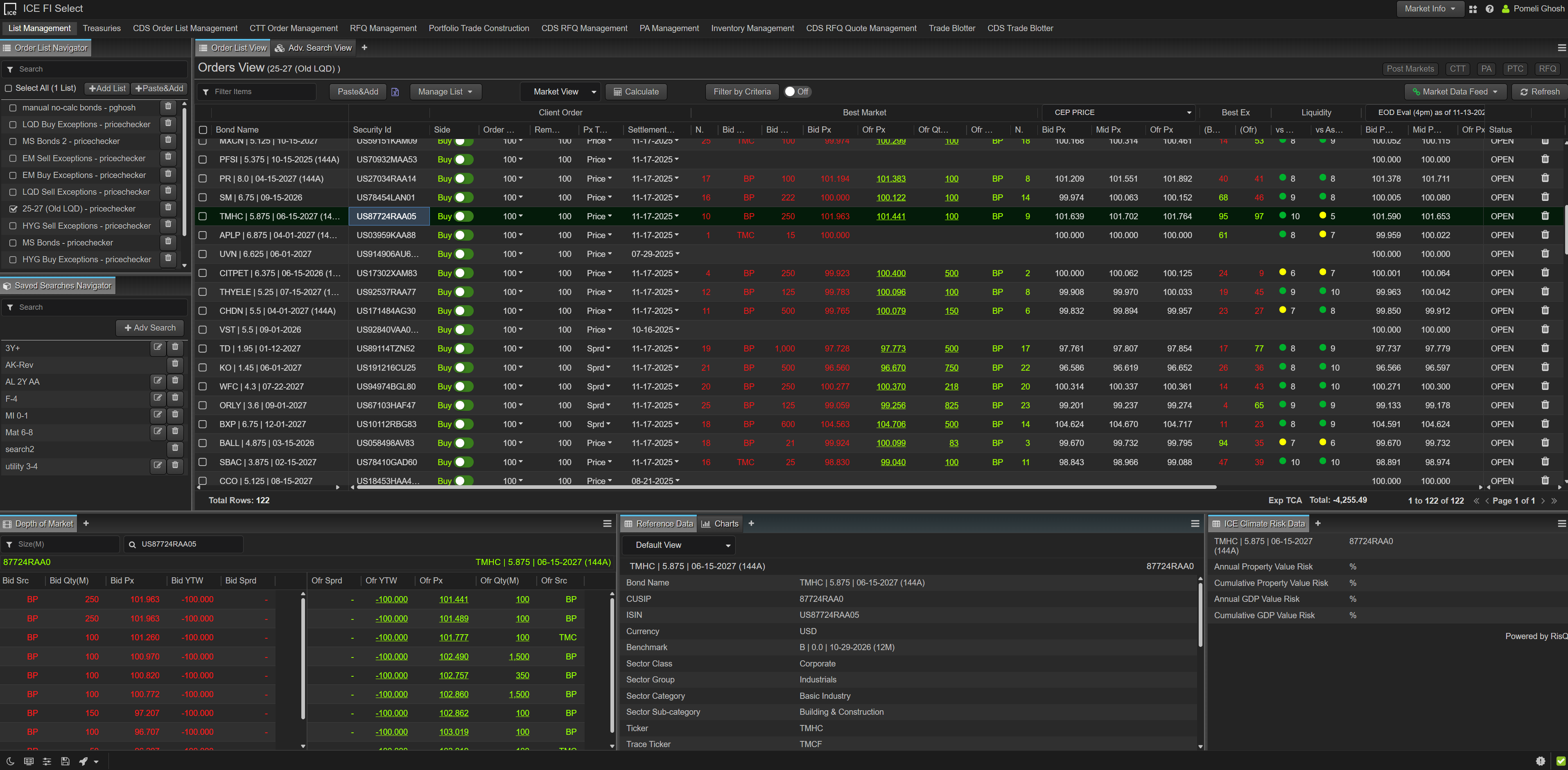

Gain workflow efficiency with your preferred trading method

ICE FI Select is a centralized access point to fixed income and credit derivative liquidity across ICE Bonds platforms including ICE TMC, ICE BondPoint and ICE Swap Trade. Integrated with leading order management systems, ICE FI Select supports automated trade workflows and direct access to deep liquidity pools without the need to log into multiple applications.

- Over 930 participating firms

- More than 500,000 live, executable markets

- Connectivity to order management systems such as BlackRock’s Aladdin, Charles River and Investortools Perform

- Consolidated STP for all ICE Bonds protocols and venues

ICE FI Select enables you to use your preferred protocols in one place

- Click-to-Trade with live and executable quotes, with over 95% affirmation rate via ICE Bonds markets.

- ICE BondPoint’s Risk Matching Auction (RMA) to reduce risk exposure

- Price-based RFQ to ICE BondPoint and ICE TMC

- Bulk execution support to lift live markets within user-defined tolerance levels

- Portfolio Auctions for corporate, emerging market, and municipal bonds

- Dealer-facing API for connectivity to internal trading and booking systems

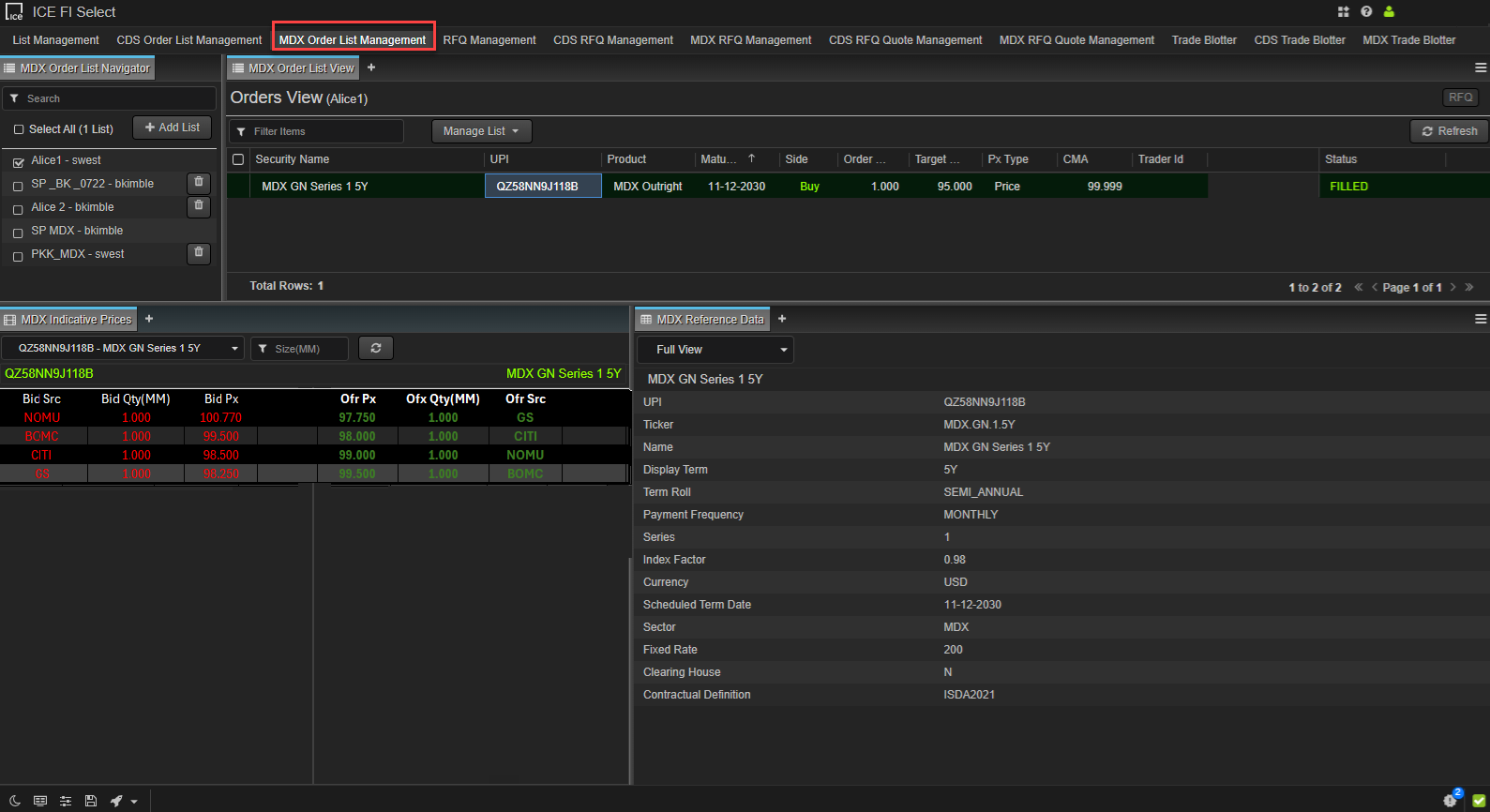

MDX Swap Trading

MDX is a new Mortgage Default Index developed by Vista Index Services.

MDX measures the cumulative credit event experience of mortgage loans in the United States. The underlying reference loans are drawn from mortgage-backed securities (MBS) issued by US government agencies that fit certain eligibility criteria.

MDX focuses solely on credit events, such as serious delinquencies and modifications. Loss severity considerations are simplified, allowing for timely determinations of MDX Index changes.

ICE FI Select supports the trading of MDX Swaps through ICE Swap Trade

Seamlessly execute MDX Swaps on ICE Swap Trade in a singular, intuitive interface through ICE FI Select.

ICE FI Select provides access to pre-trade transparency including dealer indicative pricing and CMA composite pricing. At execution, ICE FI Select provides support for Request for Quote (RFQ) and voice-processing through a simple RFQ workflow.

- Add and manage orders directly within ICE FI Select

- ICE FI Select supports ICE Swap Trades RFQ to 1 protocol where parties trade on an agreed-upon price or RFQ to 1 or More where the price is negotiated before confirming and booking the trade

- Support for the MDX composite price that displays EOD level for the swap when available

- View reference data for MDX instruments in a consolidated interface

- Dealers can post one- or two-way markets on ICE Swap Trade

Explore how we enable the trading lifecycle