Tuesday, Apr. 30, 2024

A firsthand view of Japan's recent progress

Have a conversation about global economics today and it’s likely the Japanese stock market’s impressive resurgence will be a central theme. Japan is making financial headlines once again, and it comes just a year and a half after Prime Minister Fumio Kishida laid out his economic plan in a major speech delivered from the Board Room of the New York Stock Exchange.

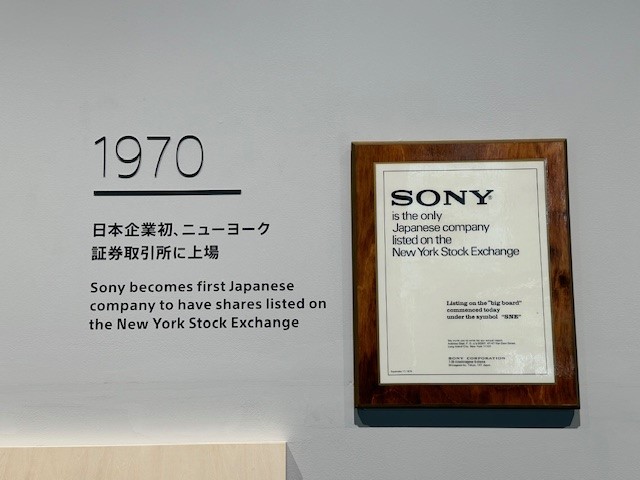

The NYSE’s relationship with Japan has been a close one for many years, with some of the nation’s largest public companies listed on our exchange. So, I was understandably thrilled to travel to Tokyo and witness Japan’s most recent progress firsthand.

It was an inspiring trip. While in Japan, I was able to meet with members of the National Diet and officials from the Bank of Japan and the Financial Services Agency. I also had discussions with leaders at the Tokyo Stock Exchange and executives of NYSE-listed companies headquartered in Japan.

Many of these individuals shared that they are seeing near-term developments and macroeconomic and geopolitical trends they believe are leading to a fundamental shift in how the world — particularly investors — sees the country after the economic stagnation that followed the postwar boom years that ran through the 1980s.

For example, Kishida’s economic reforms have included an emphasis on Nippon Individual Savings Accounts (NISA), which have encouraged increased investments in U.S. and global stock funds, as well as pushing for large trading houses to unlock value by spinning off assets. Indeed, Japanese retail investors purchased stocks through NISA at a record pace in January, according to the Nikkei Asia.

During the prime minister’s visit in late 2022, the NYSE signed a memorandum of understanding with the Tokyo Stock Exchange to support cross-border investment and collaborate on product development. This initiative led to the NYSE helping TSE to launch active ETFs, and since then we have assisted the exchange in launching 11 active ETFs.

Those I met with in Japan credited increased foreign participation in its stock market and a number of other factors in helping to create a more robust and resilient economy. Japan is also well positioned to capitalize on investments in chips, semiconductors and other high-end electronics, building on its resources and expertise in these areas.

Reflecting on my trip from the NYSE’s iconic headquarters in lower Manhattan, I am impressed and enthusiastic about Japan’s direction and achievements. We look forward to future visits by members of the Japanese government to 11 Wall Street and will continue to watch Japan’s growth with great interest.