Funding brown to achieve green

Published

July 2024

We at ICE Sustainable Finance are noticing a significant shift in the Sustainable Finance conversations among clients, industry colleagues, and broader market participants. This change which is described below was also a panel discussion topic (“Tackling Transition Finance: Next steps for investors”) at the recent Responsible Investor Europe 2024 conference.

Sentiment is shifting from climate risk to climate opportunity, with a focus on Transition Finance. This is a natural progression within financial markets as asset classes evolve, but in the case of Transition Finance there seem to be specific drivers likely accelerating this evolution.

While regulation has focused on the risk side of the equation, the adoption of measures by asset owners and managers to meet these requirements is starting to feed through and impact the investment decision making process.

Asset owners and managers are publishing their Net-Zero plans and emission reduction commitments to meet regulatory and stakeholder expectations. As a result, portfolio managers are now having to factor these Net-Zero considerations into their investment decisions, opening a whole new area of investment analysis.

This does not necessarily mean an immediate shift to green investments but does mean investments and portfolios need to start aligning to investors chosen climate (Net-Zero) pathways. At the same time, financial return expectations still need to be met. This is where the Transition Finance discussion now appears to be focusing.

To achieve this balance of climate alignment and financial return (all still within the constraints of financial risk parameters), investment decision makers are seeking the data and tools to assess and track the transition plans of their investments. Credible transition plans and target setting are important in this context, allowing continued investment in currently high emission sectors if companies remain aligned to their transition plans and Net-Zero targets.

It can be argued that this approach is consistent with mobilisation of finance needed to achieve the transition. Such a channelling of capital to help facilitate the broader transition to a low carbon economy is especially important for hard to abate sectors. Allocating capital to already “Deep Green” investments does not necessarily fund the transition.

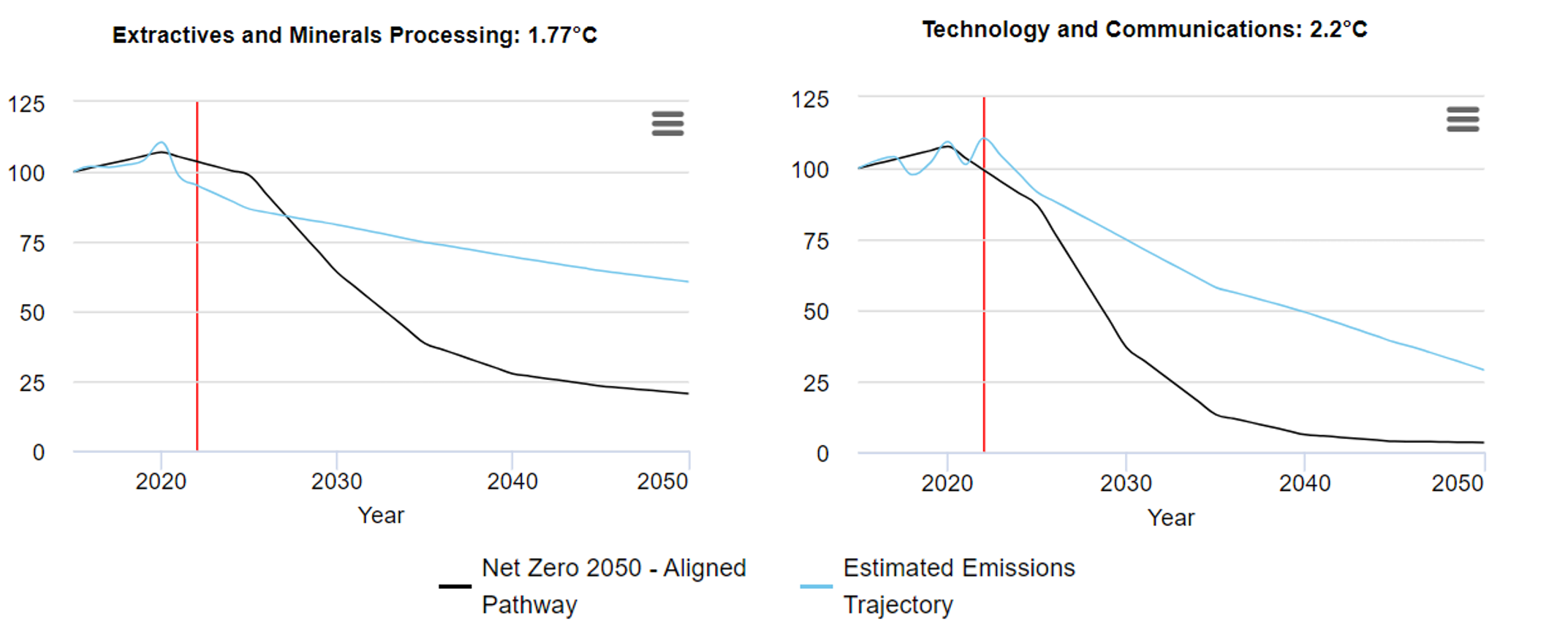

Analysis using the ICE Net Zero Analysis tools and On-Track with Targets indicator shows that investment in traditionally high carbon intensity sectors can be Net-Zero aligned. Using a sample globally diverse portfolio of companies1, the Extractives sector is found to have a lower Implied Temperature Rise (ITR) than the Technology sector, at 1.77 degrees against 2.20 degrees2, despite the Extractives sector currently considered high emission intensity and the Technology sector consider a low emission intensity sector3. Even taking Scope 3 emissions into account, the ITR for the Extractives sector at 2.48 is not too dissimilar to the Tech sector, at 2.33, for our sample portfolio.

While these findings could be viewed as pointing towards a perverse conclusion, it is important to understand that one of the key driving factors for climate scenario alignment is decarbonisation target setting. In our sample portfolio, over 50% more companies in the Extractives sector have published temperature targets compared to the Tech sector.

The Extractives sector is also found to have a higher percentage of companies (29%) that are currently on-track with their climate targets, compared to the Technology sector (21%).

This example suggests that a portfolio can be aligned to a Net-Zero 2050 pathway, while still having the capital allocation flexibility to help fund the transition in hard to abate sectors and meet financial return expectations of stakeholders, despite potential initial rises in the carbon footprint of the portfolio usually associated with such investments.

However, ongoing adherence to transition plans by individual companies is required to maintain alignment in the future, hence there is likely to be an increasing need for investor focus on Temperature Target tracking.

Exhibit 1: Net zero analysis and Implied Temperature Rise (ITR) score

Source: ICE. Implied Temperature Rise (ITR) and estimated emissions trajectory based on Scope 1 and 2 emissions under NGFS Phase 4 Net Zero 2050 Scenario.

1 Globally diverse portfolio of companies which have publicly reported full Scope 1 and 2 emissions data for at least the last two years.

2 Implied Temperature Rise (ITR) based on Scope 1 and 2 emissions under NGFS Phase 4 Net Zero 2050 Scenario.

3 Using our sample portfolio of globally diverse companies: Extractives sector intensity 1173.72 tCO2/$m revenue, Technology sector intensity 40.6 tCO2/$m revenue.