Making an Impact: Avoided Emissions

Published

June 2023

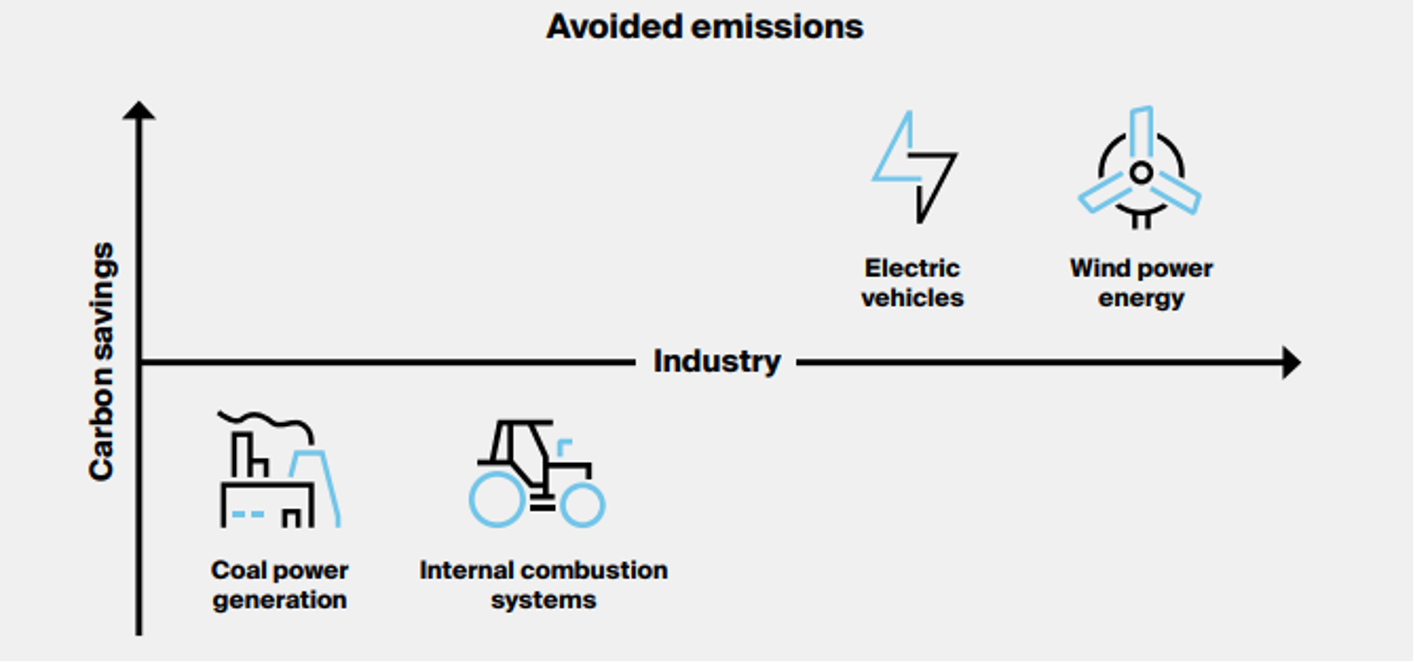

Within environmental and climate analysis, the positive impact of an investment is often not fully recognised or considered, and could be overlooked altogether.

Most metrics focus on the risk side of the climate equation (Carbon Footprinting, Net Zero Alignment, Temperature Scores, etc…), with any potential positive impact rarely taken into account. This is especially the case when that impact occurs outside a company’s supply chain or a product’s life cycle.

Climate related policy and regulation also tends to be focused on encouraging companies to reduce emissions across not only their own direct operations, but also their value chains (Scope 3). However, the need for companies to also develop innovative low or zero emissions solutions is important for global decarbonisation.

The broadening of climate analysis from the traditional one-sided (risk) approach to a more holistic understanding of an investment’s economy-wide environmental impact is gathering momentum, but generates questions, including:

How can a company’s (or investment’s) broader positive impact on the environment be quantified?

Avoided Emissions1 is one concept which aims to identify opportunities with a positive impact and quantify the real-world difference such investments can generate.

While the concept of Avoided Emissions is currently not as clearly defined as other climate metrics, the underlying intention is clear: to help stakeholders understand a company’s role in the global transition towards a low carbon economy.

From Climate Risk to Climate Opportunity

An understanding of a company’s or product’s role in the transition allows the identification of low emission and carbon reducing solutions, helping to drive investment towards these opportunities. Hence, Avoided Emissions analysis can shift the focus from Climate Risk to Climate Opportunity.

From an investor’s perspective there are many benefits from having a greater understanding of a company’s broader environmental impact. The addition of Avoided Emissions analysis to traditional climate risk analysis can provide a greater understanding of the effects of climate change at company level, enabling investors to take a more comprehensive view of climate related risk and opportunities within portfolios.

Identifying Avoided Emissions activities in revenue and/or capex (future revenues), may assist investors in finding companies with meaningful secular growth opportunities in sustainability.

In the transition to a lower carbon economy, companies that provide significant Avoided Emissions for the entire economy are potentially exposed to additional growth opportunities.

Identify Climate Opportunities

The concept of Avoided Emissions is applicable not only to the most obvious sectors, such as renewable energy and utilities. Analysis across a broader range of sectors can identify sources of potential positive impact on the transition to a low carbon economy, even in the depths of complex supply chains.

Indeed, it is not uncommon for companies in sectors with large Avoided Emissions potential not to report this information, instead there is a tendency to focus in their sustainability reports on emissions (Scope 1,2&3), the risk side of the equation.

For example, a manufacturer of cables, which are used in telecommunications, renewable energy transmission and distribution, transportation, and infrastructure, have a positive impact on the energy transition because cables are an integral component in PV (Photovoltaic) utility-scale solar, onshore, and offshore wind power transmission and distribution. Thus, when calculating the Avoided Emissions for solar and wind energy systems, a share should be attributed to the cable manufacturer.

Total Impact

The concept of Avoided Emissions has a significant role to play when it comes to providing investors with a better understanding of the overall effects of decarbonisation. Used alongside the more traditional metrics such as Emissions Analysis (Scope 1,2&3), Net Zero Alignment Analysis and Temperature Scores, will provide investors with a more holistic climate analytical framework.

The development and use of metrics aimed at measuring and promoting positive climate impact, such as Avoided Emissions, is evolving rapidly and could help to direct capital to climate solutions and innovation. Indeed, Avoided Emissions analysis allows for the narrative around a company’s environmental impact to include Climate Opportunity.

To raise awareness and understanding of the Avoided Emissions concept, ICE and Ecofin Advisors Limited published a whitepaper explaining the concept and detailing a framework to quantify Avoided Emissions for individual companies within investment portfolios.

1 “Avoided emissions are emission reductions that occur outside of a product’s life cycle or value chain, but as a result of the use of that product” - Definition of Avoided Emissions provided by the World Resources Institute (Do We Need a Standard to Calculate “Avoided Emissions”?).

Disclaimer

Use of this documentation is limited to authorized clients of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”) services. This document contains information that is confidential and proprietary property and/or trade secret of the ICE Group, is not to be published, reproduced, copied, disclosed or used without the express written consent of ICE Group.

This document is provided for informational purposes only. The information contained herein is subject to change without notice and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, investment or other professional advice. Clients should consult with an attorney, tax, or accounting professional regarding any specific legal, tax, or accounting situation.

ICE Group are not registered as nationally registered statistical rating organizations, nor should this information be construed to constitute an assessment of the creditworthiness of any company or financial instrument.

GHG emissions information available is either compiled from publicly reported information or estimated, as indicated in the applicable product and services.

Trademarks of the ICE Group include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at https://www.theice.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.

© 2023 Intercontinental Exchange, Inc.