ICE Muni Bonds Monthly Report

In November, there was over $2.1B in high physical climate riski (ICE Climate Risk Score ≥ 3) municipal issuance across the 48 contiguous states, the majority concentrated across Florida, Alabama, and Texas.

Join our mailing list to receive the newsletter and ICE Muni Bonds team updates

November 2023

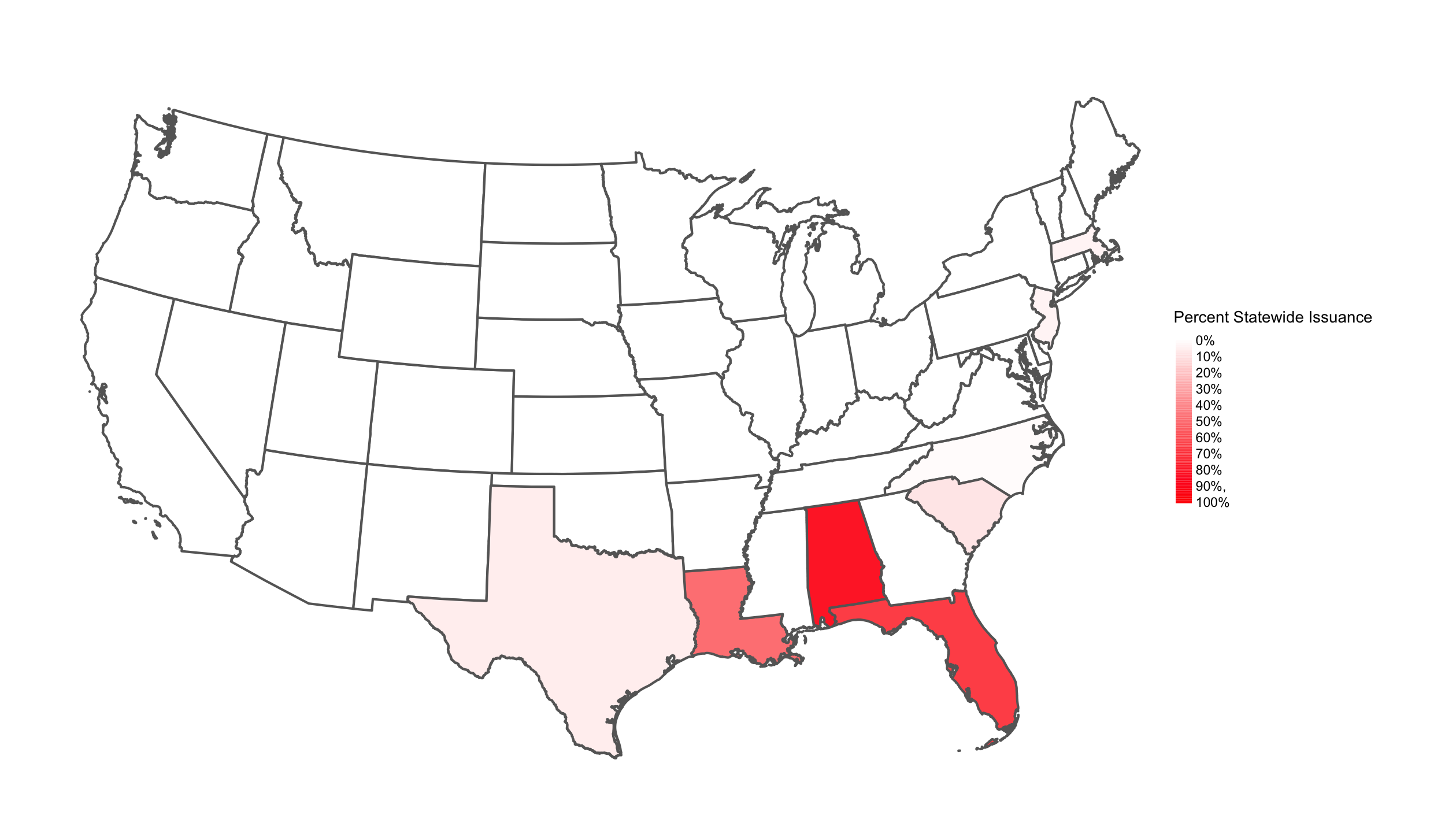

Total High Physical Risk Issuance by State

(ICE Physical Risk Score ≥ 3)

The story is a little different when we looked at statewide percentages. In November, Alabama, Florida, and Louisiana issued the largest percentages of high physical climate risk debt.

The ICE Social Impact Score is designed to indicate the potential social benefit of investment within a given community or geographical area. Areas with a higher Social Impact Score may be more socioeconomically vulnerable; investment in these communities may have greater social benefits than investment in communities with a lower Social Impact Score.

In November 2023, there was over $3.5B in municipal issuance associated with high social impact obligors (ICE Social Impact Score ≥ 75). While Texas issued the largest amounts of high social impact debt in absolute terms, states with the largest amounts in terms of statewide percentages were Arkansas, New Mexico, and Alabama.

November 2023

Percentages of High Social Impact Issuance by State

(ICE Social Impact Score ≥ 75)

Of the high social impact issuance in November, over $1B was also high physical climate risk (ICE Physical Climate Risk Score ≥ 3). This high social impact and high climate risk issuance is notable because socioeconomically disadvantaged municipalities are often the most vulnerable to the impacts of climate change—and they are also likely to be the communities most in need of investment to mitigate those same impacts.

November 2023

Percentages of Issuance by State that is both High Physical Risk and High Social Impact

(High Social Impact: ICE Social Impact Score ≥ 75)

Finally, soaring temperatures across the United States this summer have put a spotlight on the detrimental effects of heat exposure on health, productivity, and agriculture. In November, there was nearly $10B in high heat stress issuance—that is, issuance associated with obligors that are projected to experience an average of 100 or more days with a heat index greater than 95 degrees by 2050 under the Intergovernmental Panel on Climate Change’s Representative Concentration Pathway 8.5.

1All numbers and charts are sourced from ICE Sustainable Finance data and models as of 12/07/2023 and are available via product offerings. Municipal issuances outside of the 48 contiguous states are not included along with other issuances that cannot be associated with a specific geographic location.

Limitations:

This document contains information that is proprietary property and/or trade secret of Intercontinental Exchange, Inc. and/or its affiliates (the “ICE Group”), is not to be published, reproduced, copied, modified, disclosed or used in any way without the express written consent of the ICE Group.

This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between ICE Group and its respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, investment or other professional advice.

ICE Group makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. Without limiting the foregoing, ICE Group makes no representation or warranty that any data or information (including but not limited to evaluations) supplied to or by it are complete or free from errors, omissions, or defects.

ICE Group are not registered as nationally registered statistical rating organizations, nor should this information be construed to constitute an assessment of the creditworthiness of any company or financial instrument.

GHG emissions information available is either compiled from publicly reported information or estimated, as indicated in the applicable product and services.

Trademarks of Intercontinental Exchange, Inc. and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at

www.intercontinentalexchange.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.