ICE Risk Model 2

Benefits of IRM 2

IRM 2 is a portfolio-based margin model which offers full diversification benefit based on accurate estimate of the portfolio risk. The model is based on filtered historical simulation and is responsive to changing market conditions. IRM 2 includes model features which provide stability through different volatility regimes and avoids big step margin changes through its anti-procyclical add-on. The model is resilient against stress events, correlation breakdown and adjusts for seasonality where appropriate.

Accuracy & Capital Efficiency

|

Responsiveness

|

Stability

|

Risk Management

|

Ease of Implementation and Replication

|

Easily Maintained

|

IRM 2 vs IRM 1

| IRM 2 | IRM 1 | |

|---|---|---|

| Value-At-Risk IM Framework | ||

| Portfolio-Based Filtered Historical Simulation | — | |

| Anti-Procyclicality Measures | ||

| Incorporates Periods of Market Stress | ||

| Margin Offsets between Products Based on Full Portfolio Dynamics | — | |

| Natively Captures Options Pricing Dynamics | — | |

| Model Supported in ICE Clearing Analytics | ||

| LRC comprising Concentration and Bid-Ask Charges | — |

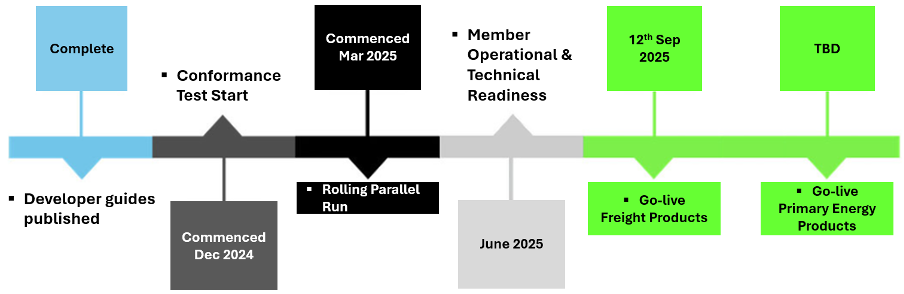

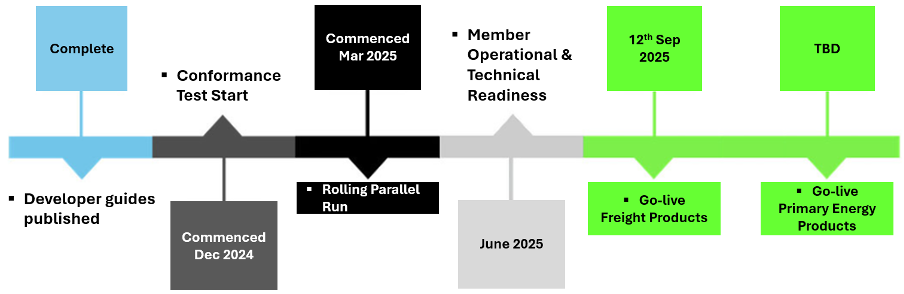

Implementation Approach

Product Scope

| Model Category | Product Groups | Link |

|---|---|---|

| Products switching to IRM 2 | ICE Clear Europe Energy Futures and Options | |

| Products remaining on IRM 1 | All remaining ICEU Products |

| Model Category | Product Groups | Link |

|---|---|---|

| Products Live under IRM 2 | Equity Index & Interest Rates Futures | |

| Products Remaining on IRM 1 | All remaining ICUS ETD Futures & Options |

Resources

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.

IRM 2 is covered under various patents and patent applications in the US, Canada, Europe and Singapore, including US Patent Nos. 10,922,755; 11,023,978; 11,216,886; and 11,321,782.