Market Regulation and Supervision

ICE Futures Europe’s (“IFEU”) objective to operate and maintain fair and orderly markets is overseen by the Market Regulation and Market Supervision departments.

Market Supervision

Market Supervision is responsible for the real-time monitoring of all trading activity on IFEU futures and options markets. Operating around-the-clock, the team provides both front-line trading and back-office support. The department is also responsible for the calculation and publication of daily settlement prices on IFEU contracts.

Contact Market Supervision

[email protected]

+44 (0)20 7382 8200, Option 2

Market Regulation

Contact Market Regulation

[email protected]

+44 (0)20 7065 7797

Market Surveillance

Member Oversight

Responsible for the on-boarding, off-boarding and ongoing oversight of IFEU Members.

Operations

Responsible for the oversight of Member position maintenance and reporting, position and expiry limits, and the administration of the Brent Crude Index.

Regulatory Reporting

Responsible for ensuring IFEU and its Members satisfy their MiFID II regulatory obligations, with particular regard to position reporting, Commitment of Traders publication, transaction reporting and order retention.

AML Counterparty Management

Responsible for the AML and KYC monitoring and oversight of prospective and existing IFEU Members.

Market Surveillance

Member Oversight

Responsible for the on-boarding, off-boarding and ongoing oversight of IFEU Members.

Operations

Responsible for the oversight of Member position maintenance and reporting, position and expiry limits, and the administration of the Brent Crude Index.

Regulatory Reporting

Responsible for ensuring IFEU and its Members satisfy their MiFID II regulatory obligations, with particular regard to position reporting, Commitment of Traders publication, transaction reporting and order retention.

AML Counterparty Management

Responsible for the AML and KYC monitoring and oversight of prospective and existing IFEU Members.

Investigations and Disciplinaries

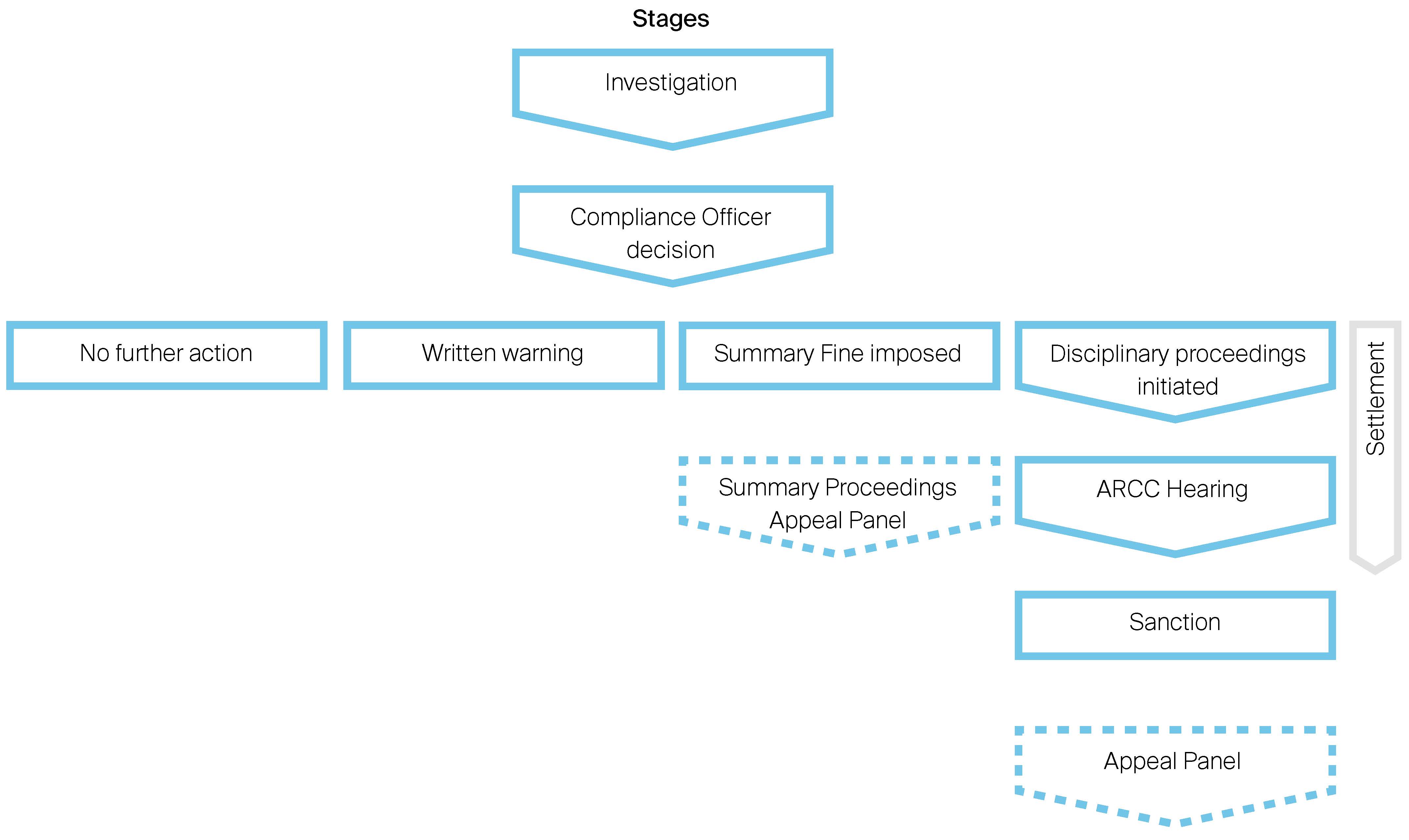

Market Regulation is responsible for enforcing compliance with the the ICE Futures Europe Rulebook. Where potential violations are identified, Market Regulation may initiate an investigation and request information from Members and market participants, including formal recorded interviews. Investigations may result in censures, fines, and/or suspension from trading where appropriate. The investigation and disciplinary process is governed by Section E of the ICE Futures Europe Rulebook. More details on the process are provided below.

ICE Futures Europe Investigation & Disciplinary Process Overview

There is one level of appeal available for Summary Fines. Appeal Hearings will be conducted in line with this procedure.

In the event of a Member Firm contests the evidence and rule breaches outlined in the Notice of ARC Committee Referral the ARC Hearing will be conducted in line with this procedure.

Market Regulation Bulletin

The purpose of the Market Regulation Bulletin is to highlight to market participants key areas of focus relating to and provide insight into the ICE Futures Europe Rules.